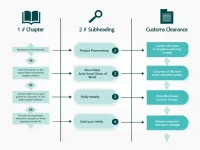

Indepth Analysis of US ISF and AMS Declarations Key Elements for Smooth Customs Clearance

This article provides an in-depth analysis of the Importer Security Filing (ISF) and Advance Manifest System (AMS) in the United States, offering importers and exporters a detailed guide on information submission and customs requirements. It emphasizes the importance of timely and accurate declarations to enhance clearance efficiency and reduce potential penalties.